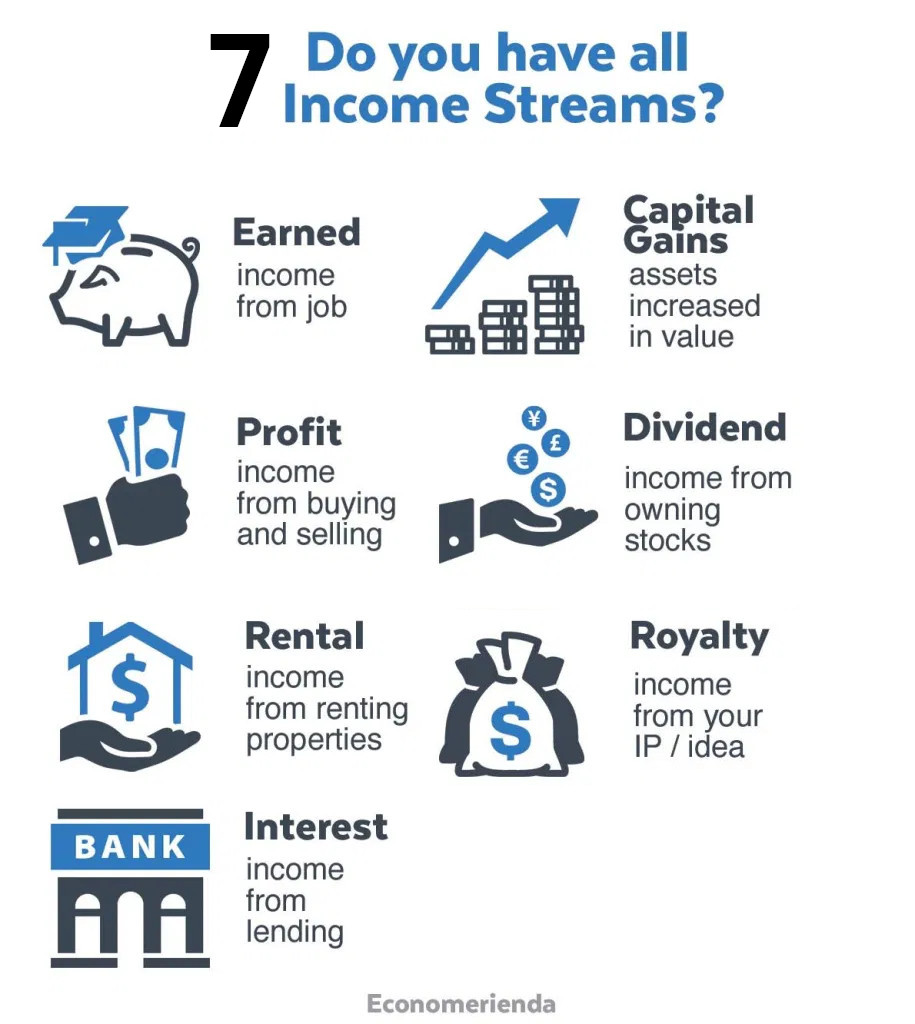

Anyone who is interested in financial management knows that millionaires have 7 sources of income.

Did you realize that there are so many ways to make money?

Yes, there are thousands of ways to make a fortune, and there are always several ways that suit you.

Let's take a brief, what are these sources of income?

1. Labor income (wage, salary)

2. Profit (business income)

3. Interests (banks time deposit, stocks, etc.)

4. Dividend (stocks, etc.)

5. Rental (real estate)

6. Capital (shares, real estate spreads)

7. Royalty (product copyright, design copyright, etc.)

1. Labor (wage, salary)

Simply speaking, it is the income that can be exchanged for physical and mental energy. The simplest is wages. Labor income is the most basic kind of active income. Even millionaires, their first pot of gold often comes from Salary. Yes, you heard it right, even if they are millionaires, their income is not entirely passive income.

The only difference is that millionaires will gradually reduce the proportion of labor income. But for most people, labor income is their most important or even the only source of income. Most of our parents or elders only have this kind of income source in their lives. Life may also be good, but with the transformation of society and the upgrading of the labor market, it is good for the younger generation that labor income can meet the basic life. Once there is something happen in their life, they will face The crisis of debt. Not only that, the stable job is getting less and less, basically no one can guarantee that they will not be unemployed. If you only have wage income as a source of income, can you guarantee that you can survive when the old and new jobs are not available. At the same time, the tax payable to receive wages is often the highest. Generally speaking, in different countries, the income tax is about 20%-40%. And, it is very difficult to get out of the wage box. Because of labor The nature of income requires us to spend a lot of time and energy. Even if it’s from 9 to 5, we don’t work overtime and only work 5 days a week. This labor model also takes up most of our effective work week. Many people don’t have the energy to develop other income after a day’s work. But if you are staying with the status quo, you will live your life on labor income basis. You can never have enough money to live a better life. It is even more impossible to retire early.

2. Profit (business income)

Profit is the income obtained from doing business. The common form is the income earned by selling products or services. Whether it is retail or wholesale, whether it is opening a physical store, or opening a store on the Internet. The income earned is related to profit income Profitable income may not be suitable for everyone. Doing business requires a lot of time and money in the early stage. Even so, many businesses still face bankruptcy in the first year. Want to successfully earn income by doing business, possess entrepreneurial spirit and risk taking ability is a must. Another important point is financial management ability. Many people neglect financial management because the scale of their business is small. However, this is the main reason for most business bankruptcies. Many people are in their professions at a certain stage in your career, sometimes have the idea of earning this kind of income from business. But you will find it difficult to start. The first reason is because everything is difficult at the beginning, and the second is the lack of courage to take risks. In most cases, it’s hard to people to step forward because of the family issues and the limitations of existing jobs. The first step is always difficult to take. To become an entrepreneur and start earning profits, you need to determine the products or services you want to sell. Do your preliminary research and write a good business plan. Conduct finance, marketing, Sales, as well as customer analysis, etc. Many people will hire professional consultants to assist to complete processes. For most people, labor income and profit income are the only feasible ways to make a large income. But there are other Five equally viable sources of important wealth.

3. Interests (banks time deposit, loans, etc.)

Interest refers to lending your own money to others to earn interest. The entry-level interest income is time deposited in the bank. Many people disagree with this. After all, bank interest rates are often kept at a low level of 1%-5% It is amazingly low. However, don’t underestimate this insignificant 1%. Here, please believe in the power of compound interest. No matter how low interest is, after years of accumulation, even if it is better than inflation, it is better than standing still. At the same time interest is also a form of passive income that does not require excessive investor involvement. Once the investment is completed, you can sleep and make money. And the risk of bank deposits can be negligibly low. Many fund managers will also cooperate with some banks and put deposits in the fund product mix. In addition to depositing in the bank, the advanced version of interest is loaned to the government in the form of buying bonds. It is also a low-risk and low-return investment. Interest is the most suitable for investors who lack financial knowledge and have no time to manage money.

4. Dividend (stocks, etc.)

Dividend is one of the important sources of income for the stock master Warren Buffet.

Only Buffett’s five favorite stocks in 2019, Wells Fargo, Apple, Bank of America, Coke Cola,

KraftHeinz, brought him $3.4 billion in annual dividend income. Dividend is the income you get from stock returns. It is also passive income.

Not only that, but it also allows you to become a shareholder of the company. Most companies pay quarterly or annual dividends. Of course, some companies do not pay dividends.

Everyone must understand it before buying.

If you buy stocks of outstanding blue chip companies before the ex-dividend date,

Then dividend income may far exceed interest income.

Because you can also benefit from the capital appreciation of the stock.

Another benefit of dividend income is low taxes.

In different countries, the tax rate on dividend income is also different.

Generally between 0%-20%.

Compared with the taxes paid on wage income in most countries,

It's really low.

5. Rental (real estate, cars)

Many people know that the return on investment from real estate investment can be amazing.

Rental and income from renting out real estate.

In the past, investors needed to spend large sums of money to buy real estate for rent.

Today, the way to obtain real estate has become more flexible,

The easiest way is that many governments encourage program,

Since it is encouraged by the government, you can often enjoy a series of preferential policies.

And you only need to pay the down payment, and then get real estate through the loan,

Then rent out the property to earn rental.

There is another way,

it is to obtain permission from the owner of the house,

You got the business rights,

Then use the house as a family hotel for profit.

These two methods are for people with tight funds,

Lower the threshold of real estate investment,

Of course, the rental income still has its own limitations.

Limitation #1, relatively large capital investment.

Another big disadvantage is liquidity.

When you need money, or when you adjust your portfolio,

It is difficult to cash out this kind of asset quickly.

In addition, car rental is also another kind of rental income.

6. Capital (shares, real estate spreads)

Capital refers to the income you get from the appreciation of the assets you own. Common assets are stocks and real estate. For example: When you buy a stock at USD100 and sell it at USD120, This USD20 is your capital income. Or, you buy a house at USD2Million and sell it at USD2.2Million, That 0.2Million is also your capital income. Capital income and dividend income have a common feature: low tax rate. Generally speaking, the tax rate on capital income is 10%-20%. In some cases, it can reach 0%.

7. Royalty (product copyright, design copyright, , patents, etc.)

Royalty income can be said to be the ultimate form of passive income. Trademarks, copyrights, patents, Copyright income is when you authorize others to use your product, creativity, design, For example, when we shop online, we need to add products to the shopping cart. Then perform centralized settlement. However, on Amazon.com, you can click "Buy It Now" and you can do it in one step. There is no need to fill in the address and credit card information. This was first launched by Amazon founder Jeffery Bezos in 1997. When he launched it, he applied for a patent on Buy It Now. Companies such as Apple are currently using this payment model. In the past 20 years, this patent, Brings more than $1 trillion in revenue to Jeffery. Other forms of copyright income, such as Amazon books and spotify.com music. For example, if you are a novelist, every time a publisher sells your book, You will get royalties. If your novel is adapted into a TV series, You will also receive the corresponding benefits. If you are a singer and an anchor, Your audio product is listed on spotify.com, You will also receive royalties based on the number of times the audio has been played. There are franchisees for relatively high-end royalty income, When you create your business model and achieve success, Other people want to join your brand, The initial fee they pay is also a kind of royalty income. The biggest challenge in earning this income is originality. And continue to introduce new ones, This requires special skills to create. But once the results are created, such as books, works of art. The income you can earn may be incalculable.

Conclusions

These above are the 7 sources of income, Creating a source of income is not just a survival skill, It is also a strategy to build wealth. Want to create multiple sources of income, It can't be achieved overnight. You need to understand each source of income in detail, Choose the one that suits you. Try different sources of income, your life may change as a result.

Philippine Peso Exchange Rate

Philippine Peso Exchange Rate